Margin loan on 401k

-5000 Pay margin interest. Trading on margin by definition involves a loan says Ajay.

The Margin Loan How To Make A 400 000 Impulse Purchase Mr Money Mustache

Get started with margin in three simple steps.

. 800-343-3548 Chat with an investment professional 1. So in the first case you profited 2000 on an investment of 5000 for a gain. COVID hits and your shares suddenly go down 50 total value is now 100k BUT that.

Yes provided that you are both working in the same self-employed business. 800-343-3548 Chat with an investment professional New issue equity offerings are not margin eligible for at least 30 calendar days. Legally you generally cant margin trade with an IRA because the IRS prohibits the use of IRA funds as collateral.

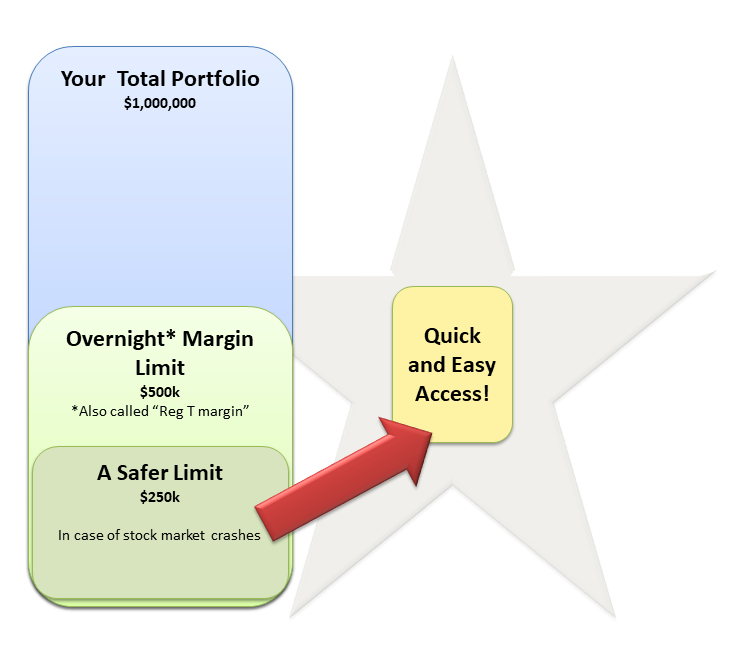

As a rule of thumb you should control your risks by keeping margin down to no more than 15 percent of your portfolio. Margin accounts allow you to borrow against the value of stocks and other investment securities in your account and you can use borrowed cash for personal purposes. Apply for margin Log in and from.

If the loan balance is pushed to the limit 50 percent of. A margin loan may be an alternative approach to help meet short-term financial needs that are not related to trading. Of that 3600 is profit.

It sounds like you get taxed. If your margin equity falls below a certain amount based on the amount you have borrowed then the account is issued a margin call. Im looking into different ways to fund deals and am curious about using my.

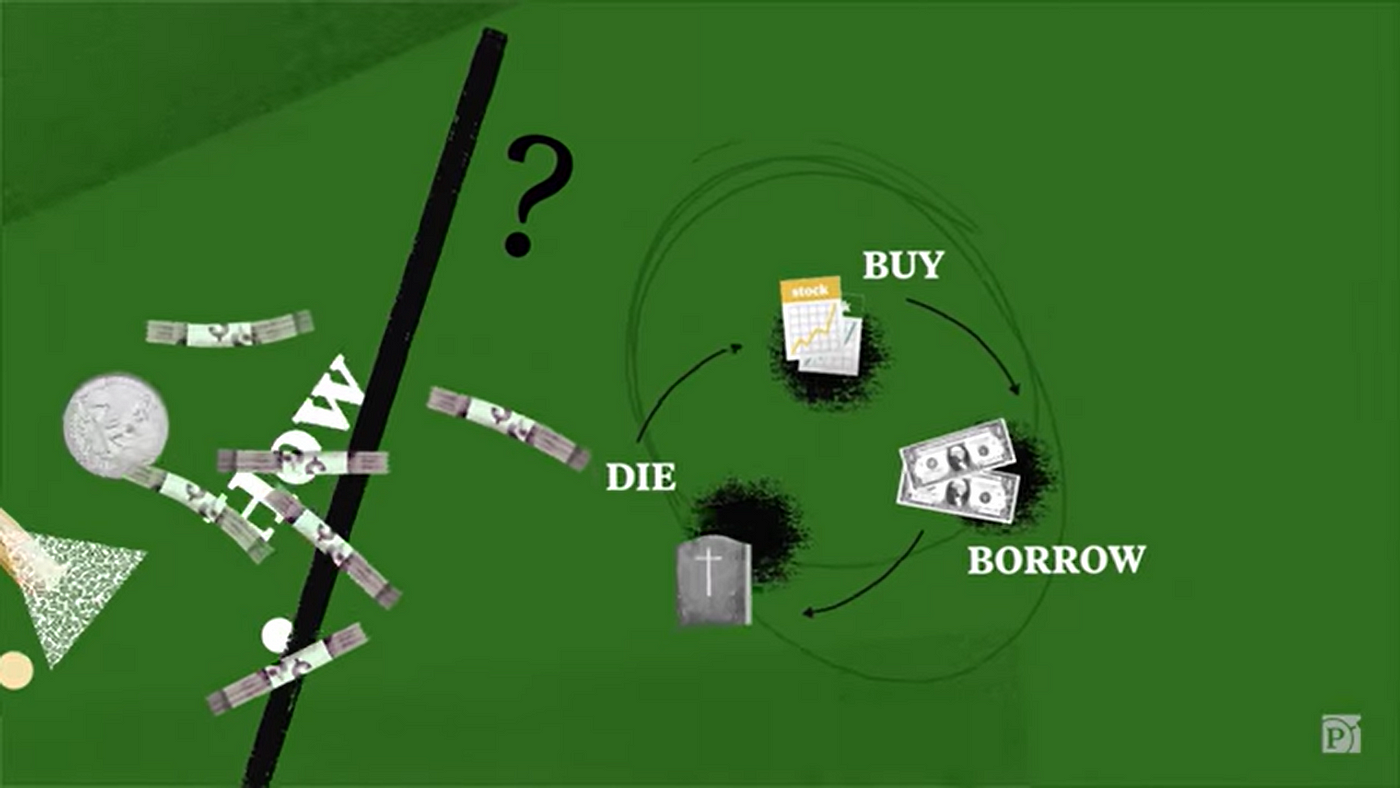

Would a margin stock account within a solo 401k be worth it. If you decide to borrow 50000 your account market value. Given that the remodeling budget is well within the maximum amount you are able to borrow on margin this may be a viable option.

You sell and pay back 5000 plus 400 of interest 1 which leaves you with 8600. Margin loans typically require a minimum of 2000 in cash or marginable securities and generally are limited to 50 of the investments value. You invest your 100k borrow that second 100k and buy the same 200k of shares.

Borrowed funds secured by an asset are an acceptable source of funds for the down payment closing costs and reserves since borrowed funds secured by an asset. If your margin equity falls below a certain amount based on the amount you have borrowed then the account is issued a. You may be required to sell securities or deposit funds to.

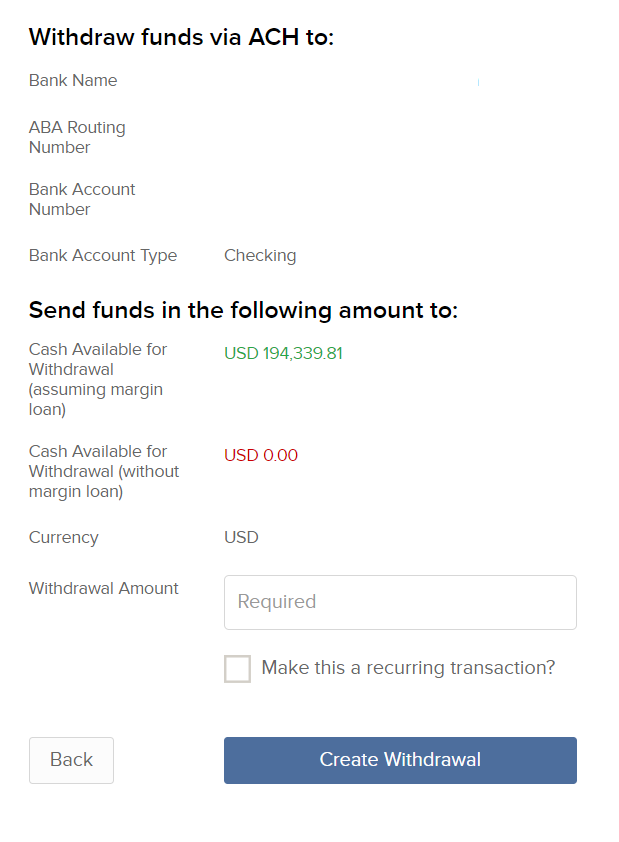

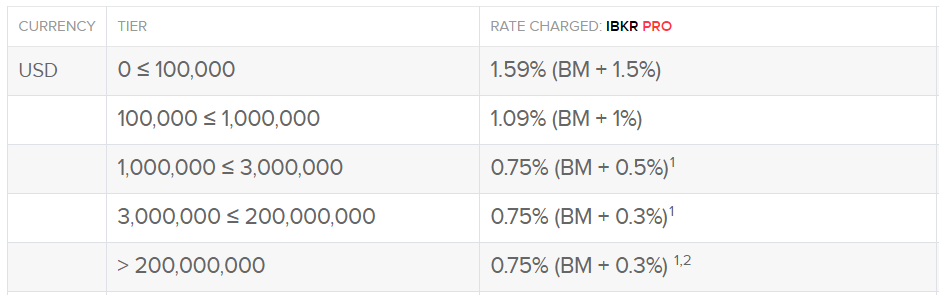

625 rate available for debit. In fact using this type of loan rather than selling existing securities or using. Posted Nov 28 2020 1347.

Open a brokerage account Open an account online call us at 866-232-9890 or visit one of 300 local branches. 3600 So in the first case you profited 2000 on an investment of 5000 for a gain of 40. Interest rates vary depending on the amount being.

With a 401 k loan you borrow money from your retirement savings account. Depending on what your employers plan allows you could take out as much as 50 of your. 401k IRA Margin Loans.

Repay margin loan.

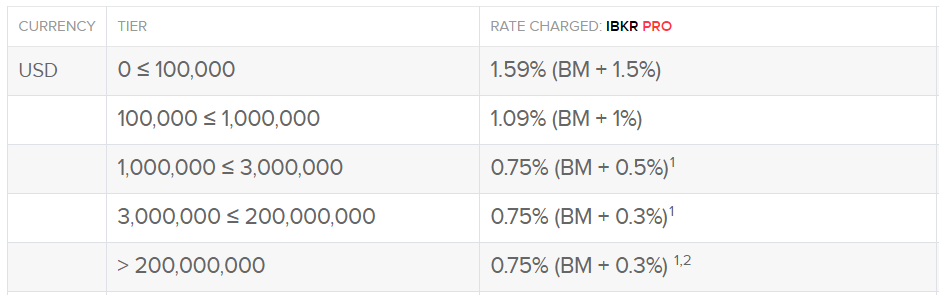

Buy Borrow Die How The Rich Stay Rich By Vic Danh Financial Independence Retire Early Medium

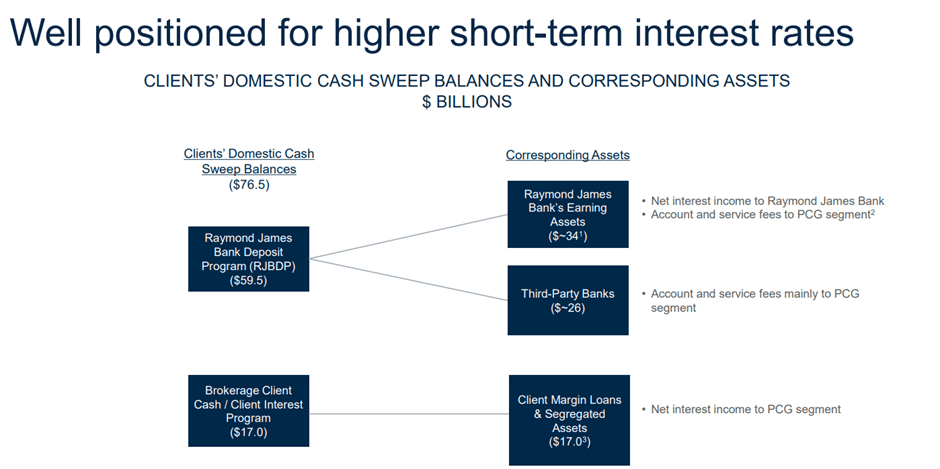

Raymond James Stock Compelling Setup Into The Rate Hike Cycle Seeking Alpha

The Margin Loan How To Make A 400 000 Impulse Purchase Mr Money Mustache

Can You Owe Money On Stocks You Ve Invested In

Margin Account Vs Cash Account Differences Pros Cons Seeking Alpha

Ubiquity 401 K Plan Review An Option For The Self Employed How To Plan Credit Counseling Debt Snowball

The Mega Backdoor Roth Ira Practice Retirement Plan

The Margin Loan How To Make A 400 000 Impulse Purchase Mr Money Mustache

How Do Rich Avoid Taxes Case Studies White Coat Investor

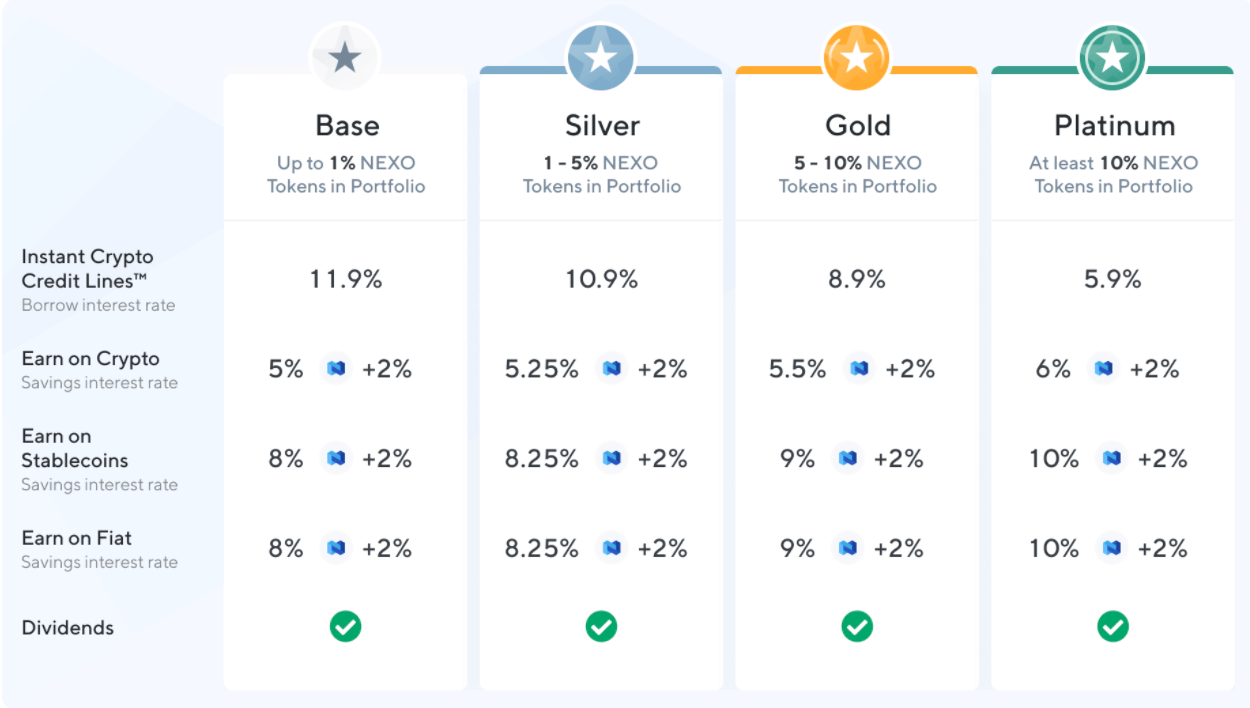

Crypto Lending Platforms Add Liquidity But Also Leverage To The Market Seeking Alpha

/GettyImages-11698550571-7d63bd56039541dea5effdacf31fd3b1.jpg)

What Happens If I Can T Pay A Margin Call

The Margin Loan How To Make A 400 000 Impulse Purchase Mr Money Mustache

Secure Act 2 0 Getting Closer To Reality

Buy Borrow Die How The Rich Stay Rich By Vic Danh Financial Independence Retire Early Medium

Buy Borrow Die How The Rich Stay Rich By Vic Danh Financial Independence Retire Early Medium

The Risks Of Buying On Margin

401k Vs Real Estate Where To Invest White Coat Investor